kentucky sales tax on-farm vehicles

For vehicles that are being rented or leased see see taxation of leases and rentals. How to Calculate Kentucky Sales Tax on a Car To calculate the.

Farmers Encouraged To Apply For New Agricultural Exemption Number

Since Kentucky sales tax is simply 6 of the total purchase price estimating your sales tax is simple.

. Kentucky does not charge any additional local or use tax. 650 Definitions for KRS 186650 to. SALES AND USE TAX The sales and use tax was first levied in its current form in 1960.

The deadline for farmers to obtain their agriculture exemption license number has been extended until January 1 2023. In addition to taxes car. The agriculture exemption number is valid for three years from the.

Vehicle rental excise tax Instead of implementing a rental tax on motor vehicles Kentucky charges a motor vehicle. The Kentucky state sales tax rate is 6 and the average KY sales tax after local surtaxes is 6. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles.

Or vehicles with 3 or more axles regardless of weight to. All agriculture exemption license numbers will expire on. Groceries and prescription drugs are exempt from the Kentucky sales tax Counties and cities.

The state of Kentucky has a flat sales tax of 6 on car sales. Of course you can also use this handy sales tax calculator to confirm your. The deadline to apply for the new agriculture exemption number for current farmers is January 1 2022.

Exempt from weight distance tax in Kentucky KYU. This license is required for interstate carriers with a gross vehicle weight or a registered gross vehicle weight exceeding 26000 lbs. Kentucky Department of Revenue Division of Sales and Use Tax PO Box 181 Station 67 Frankfort KY 40602-0181.

The retailer must collect Kentuckys 6-percent sales tax on the fee. Several exceptions to this tax are most types of farming. In the state of Kentucky legally sales tax is required to be collected from tangible physical products being sold to a consumer.

How This Farmer S Amazon Career Helps Him Feed His Community

Kentucky Department Of Revenue Revenueky Twitter

Kentucky S Car Tax How Fair Is It Whas11 Com

5 Tax Tips Every Farmer Should Know About Credit Karma

Answers To Common Agriculture Tax Exempt Questions Lifestyles Somerset Kentucky Com

New Ky Farm Tax Exemption Forms Youtube

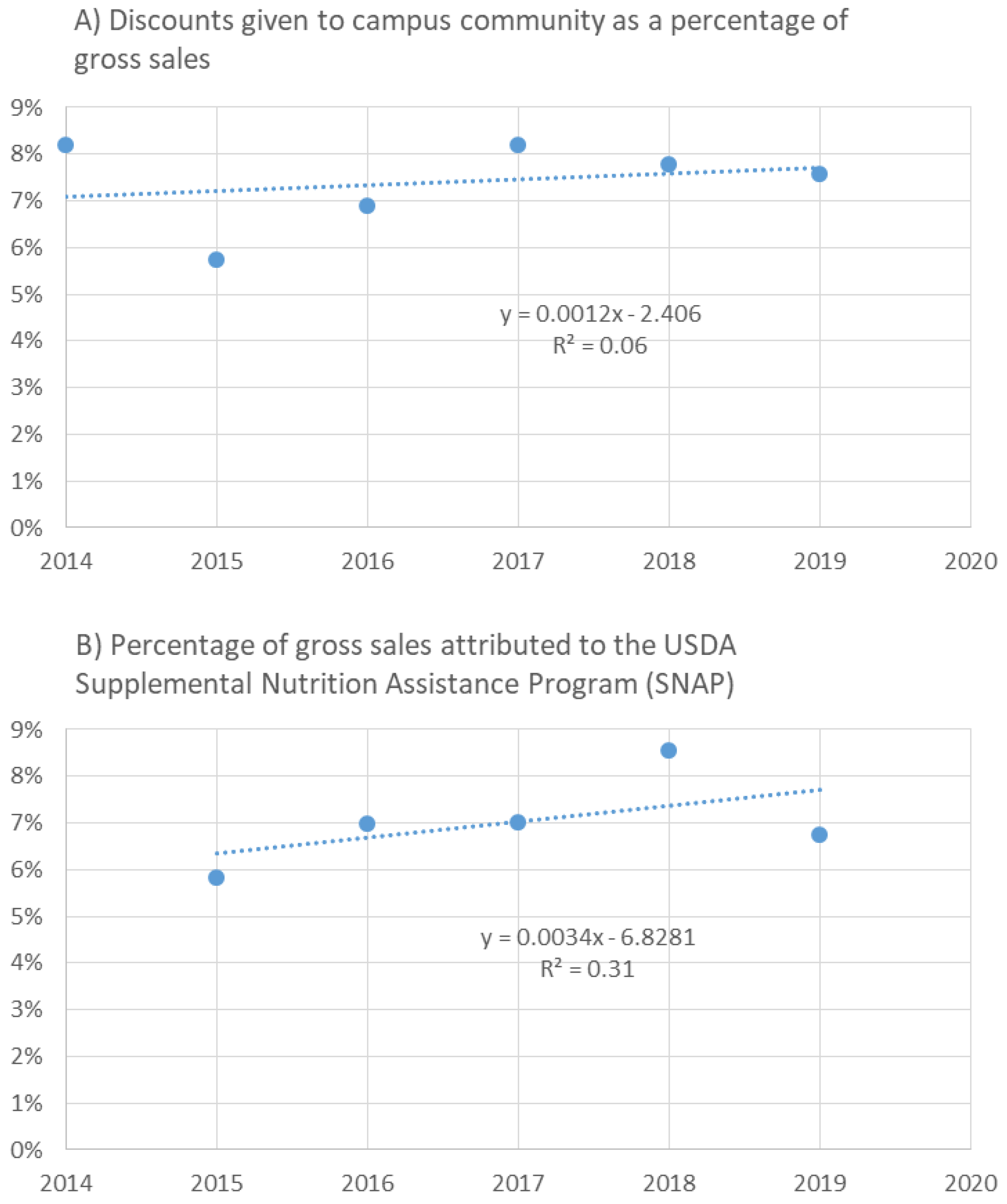

Sustainability Free Full Text Financial Viability Of An On Farm Processing And Retail Enterprise A Case Study Of Value Added Agriculture In Rural Kentucky Usa Html

Kentucky Sales Tax Exemption For Manufacturers Agile Consulting

Free Farm Tractor Bill Of Sale Form Pdf Word Eforms

Agriculture Exemption Number Now Required For Tax Exemption On Farm Purchases Agricultural Economics

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kenworth Trucks For Sale In Kentucky 38 Listings Truckpaper Com Page 1 Of 2

Peterbilt Trucks For Sale In Kentucky 37 Listings Truckpaper Com Page 1 Of 2

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Eastern Kentucky Farm Equipment For Sale Facebook

Can You Drive A Farm Truck Without A License Farming Base

Mack Trucks For Sale In Kentucky 25 Listings Truckpaper Com Page 1 Of 1